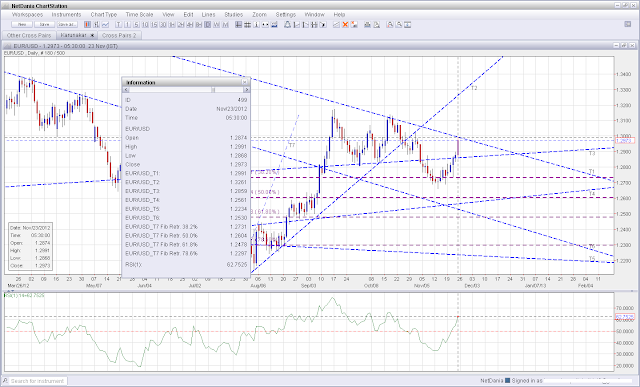

Date: 26/11/2012

The price has reversed from 50% retracement on daily chart and I hope and assume the downtrend has resumed. I will like to go short at appropriate level.

|

| Chart 1 - Daily chart |

Looking at 4hr chart, both the defense of support trendlines is broken. This is in confirmation with daily analysis and direction. We will look to go short at appropriate level.

|

| Chart 2 - 4hr chart |

Bias: Short

Entry: Around 0.9750

Stop loss : 0.9825

Target : <Open>

===============================================================

Update: 26/11/2012

Trade - 1

Entry: When short at 0.9712 with RSI hovering at around 60

Stop loss : 0.9830

Target : <Open>

===============================================================

Update - 30/11/2012

The plan layed out on 26/11/2012 has worked to pip. The price has hit the defined level precisely at 0.9750 before resuming falling. See Chart 3. The RSI on 4 hr chart has entered into oversold level.

We will refrain from entering into another trade until this pressure is either released or neutralized.

|

| Chart 3 - 4 hr |