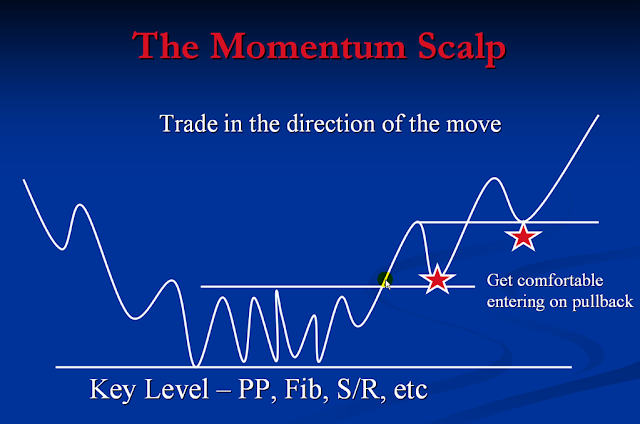

Momentum scalp setup

General Order rules for Momentum Entry

1. When a key level is penetrated, look for the market to retest/bounce at the level and offer a potential trade.

2. Only trade this when the trend is clear.

3. When the market penetrates the level and makes a new high/low, measure the distance from the potential retest level to the high/low that was recently achieved, to assess if there is potential for profit.

How to determine Potential reaction levels

1. Start by observing the previous day's high and low and intraday support and resistance levels on a 15, 30 or 60 min chart.

2. Then move to higher timeframe and note key reaction levels ("Key Levels")

3. Mark Support/Resistance levels, Fibs, Trendlines and Pivot levels

4. Scroll down to the smaller timeframes to watch the market Reaction and stalk the trade.

Trade preparation and Scalping checklist

1. Using your tools, support/resistance, Fibs, pivots, trendlines, etec, establish your near term "Key reaction" levels on a 15 min, 30 mins and/or 1hr chart.

2. Also watch your 5 min chart.

3. Mark the notable key reaction levels on the higher timeframes, in the event it is a strong trending or large ranging day.

4. Stalk the levels and anticipate a trade.

5. Be mindful of any economic reports due in the session ahead

6. Be mindful of time of day. The London and NY sessions are more volatile than the Asian session.

7. #1 Rule - Trade into a bold faced candle that is moving in the direction opposite to the direction of the intended position and trade it at a "Key Reaction Level"

8. Place a reasonably tight stop and move it closer to entry after the market has responded to the key reaction level.

9. Take at least 60% of the position out of the market when 10 pip in profit and move your stop accordingly.

10. It is High Risk! Be careful out there!

General Order rules for Momentum Entry

1. When a key level is penetrated, look for the market to retest/bounce at the level and offer a potential trade.

2. Only trade this when the trend is clear.

3. When the market penetrates the level and makes a new high/low, measure the distance from the potential retest level to the high/low that was recently achieved, to assess if there is potential for profit.

How to determine Potential reaction levels

1. Start by observing the previous day's high and low and intraday support and resistance levels on a 15, 30 or 60 min chart.

2. Then move to higher timeframe and note key reaction levels ("Key Levels")

3. Mark Support/Resistance levels, Fibs, Trendlines and Pivot levels

4. Scroll down to the smaller timeframes to watch the market Reaction and stalk the trade.

Trade preparation and Scalping checklist

1. Using your tools, support/resistance, Fibs, pivots, trendlines, etec, establish your near term "Key reaction" levels on a 15 min, 30 mins and/or 1hr chart.

2. Also watch your 5 min chart.

3. Mark the notable key reaction levels on the higher timeframes, in the event it is a strong trending or large ranging day.

4. Stalk the levels and anticipate a trade.

5. Be mindful of any economic reports due in the session ahead

6. Be mindful of time of day. The London and NY sessions are more volatile than the Asian session.

7. #1 Rule - Trade into a bold faced candle that is moving in the direction opposite to the direction of the intended position and trade it at a "Key Reaction Level"

8. Place a reasonably tight stop and move it closer to entry after the market has responded to the key reaction level.

9. Take at least 60% of the position out of the market when 10 pip in profit and move your stop accordingly.

10. It is High Risk! Be careful out there!